With regards to financing your house, one to size will not fit the. Even though traditional choices including money, home equity lines of credit (HELOCS), refinancing, and you can contrary mortgages could work well for the majority of residents, the brand new recent go up off mortgage selection such domestic security traders and you may almost every other emerging programs have really made it clear that there is an expanding need for other options. Find out about option how to get equity from your household, in order to make an even more told choice.

Old-fashioned Selection: Positives and negatives

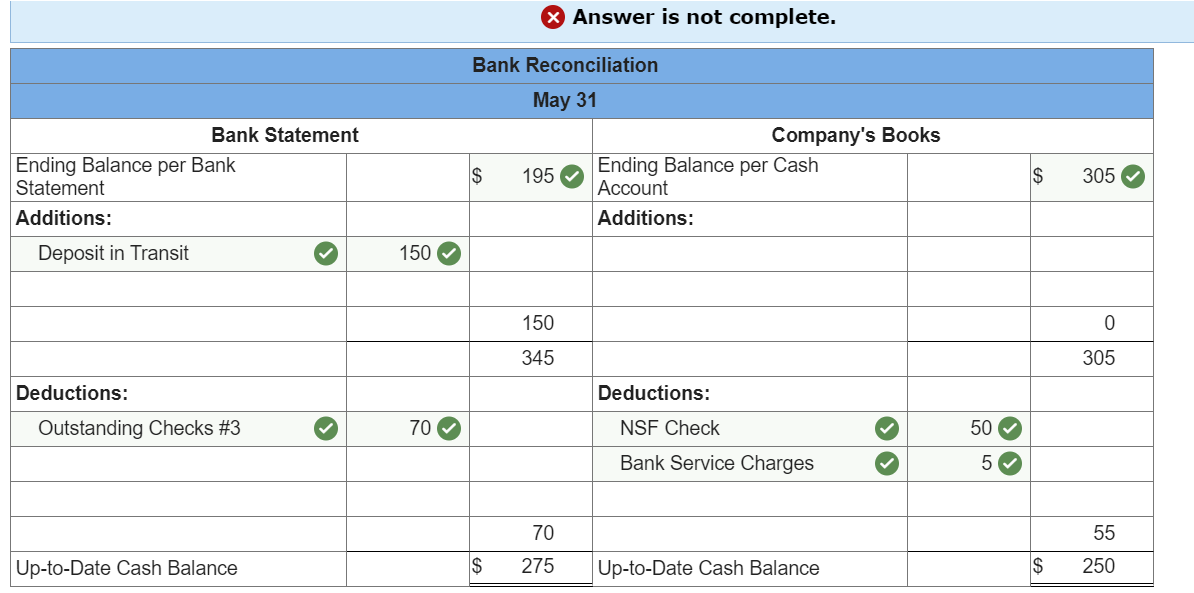

Fund, HELOCs, refinancing, and you will opposite mortgages can all be attractive a method to utilize brand new equity you built up of your property. However, you’ll find usually as numerous cons and there is advantages – so it’s crucial that you comprehend the positives and negatives of each to understand as to why some people want resource alternatives. Comprehend the chart less than so you can rapidly compare loan possibilities, after that keep reading to get more home elevators each.

Family Guarantee Loans

Property collateral loan is one of the most prominent suggests you to home owners accessibility their guarantee. You will find professionals, together with a predictable payment per month because of the loan’s repaired interest speed, plus the undeniable fact that you’re getting new collateral in one single lump sum percentage. For this reason, a property security financing usually makes sense if you are searching so you’re able to shelter the price of a renovation opportunity or large that-of bills. As well as, your own focus repayments can be taxation-deductible if you find yourself utilizing the currency to have home improvements.

Why identify a home security mortgage solution? Several factors: Very first, you’ll want to pay back the mortgage including their typical home loan repayments. And if your own borrowing from the bank is smaller-than-advanced (significantly less than 680), you might not also be accepted to own a home collateral loan. In the long run, the program procedure are going payday loans locations in Penton to be invasive, difficult, and you can taxing.

Family Security Credit lines (HELOC)

HELOCs, a common replacement a property collateral financing, bring quick and easy use of funds should you you desire him or her. And while your usually you would like a minimum credit history away from 680 to help you qualify for a beneficial HELOC, it does actually make it easier to alter your score over the years. What’s more, you are capable delight in income tax professionals – deductions doing $100,100000. Because the its a line of credit, there isn’t any focus due if you do not pull out money, and you will remove to you desire up until your struck your maximum.

But with it autonomy will come the opportunity of extra debt. Particularly, if you are planning to use it to pay off credit cards with higher rates, you could end racking up far more fees. So it in fact happen frequently that it is proven to loan providers because reloading .

Other biggest downside that can prompt people to get a good HELOC solution is the instability and unpredictability that comes additionally alternative, as variability inside rates may cause changing debts. Your own bank may frost your HELOC when – or decrease your credit limit – in case there is a decrease on your own credit score or home worthy of.

Find out how preferred its having property owners like you to apply for lenders and HELOCs, within 2021 Homeowner Statement.

Cash-away Refinance

You to replacement for a property collateral financing is a money-aside refinance. One of the primary rewards of a funds-away refinance is you can safer a lowered interest on your financial, and therefore down monthly payments and more cash to cover other expenditures. Otherwise, if you’re able to create higher payments, good refinance will be a good way to reduce the financial.

Definitely, refinancing has its own set of pressures. Given that you will be basically paying off your financial with a new one to, you are stretching your own mortgage schedule and you are clearly stuck with the exact same charge your handled to begin with: application, closure, and you will origination costs, identity insurance, and possibly an assessment.

Total, you’ll pay between one or two and you can six % of one’s overall amount your borrow, according to the specific financial. However-called no-cost refinances are going to be misleading, as the you will likely has a high rate to pay. Whether your number you happen to be credit was more than 80% of one’s home’s worth, you will probably need to pay to have private mortgage insurance policies (PMI) .

Cleaning the latest obstacles of software and you will qualification may cause dry comes to an end for some home owners that imperfections to their credit score or whose results only aren’t satisfactory; extremely lenders wanted a credit rating with a minimum of 620. These are just a few of the factors property owners will discover themselves trying an alternative choice to a profit-out re-finance.

Opposite Mortgage

Without monthly obligations, a face-to-face financial can be ideal for elderly people searching for more cash during advancing years; a recent estimate about National Contrary Mortgage lenders Connection receive one senior citizens got $7.54 trillion tied up in the a home equity. not, you might be however responsible for the brand new percentage out of insurance and you can taxation, and require to remain in the house to your longevity of the borrowed funds. Reverse mortgage loans also have a get older element 62+, hence rules it once the a feasible choice for of a lot.

There is lots to adopt when looking at traditional and you may solution an effective way to supply your home security. Next publication can help you browse per option even further.

Selecting a choice? Enter the Household Collateral Funding

A more recent alternative to home equity loans are domestic guarantee assets. The great benefits of a house guarantee funding, particularly Hometap offers , or a shared like agreement, are numerous. Such traders make you close-quick access into the guarantee you’ve produced in your house inside the exchange to possess a share of their future worth. At the conclusion of this new investment’s active months (hence relies on the organization), your settle the fresh new money by purchasing it out that have savings, refinancing, otherwise offering your residence.

Which have Hometap, plus a simple and easy smooth application process and you may novel qualification standards which is often far more inclusive than simply that of lenders, you will have one-point from contact in the capital experience. Perhaps the key change is the fact in the place of such more conventional channels, there are not any monthly payments or interest to consider into the best of your home loan repayments, in order to reach finally your financial requirements faster. When you’re seeking to alternative ways to get equity out of your household, handling a property security individual would-be value examining.

Was a great Hometap Investment the right household collateral mortgage alternative for you and your property? Capture our very own four-time test to find out.

I manage our better to guarantee that the information when you look at the this information is while the perfect that one can by the fresh time its typed, however, one thing change rapidly possibly. Hometap cannot endorse otherwise screen one linked websites. Private issues differ, so consult with your very own finance, tax otherwise law firm to determine what makes sense to you.

Leave a Reply